Proven Techniques for Financing Collection: Trust Fund the Specialists

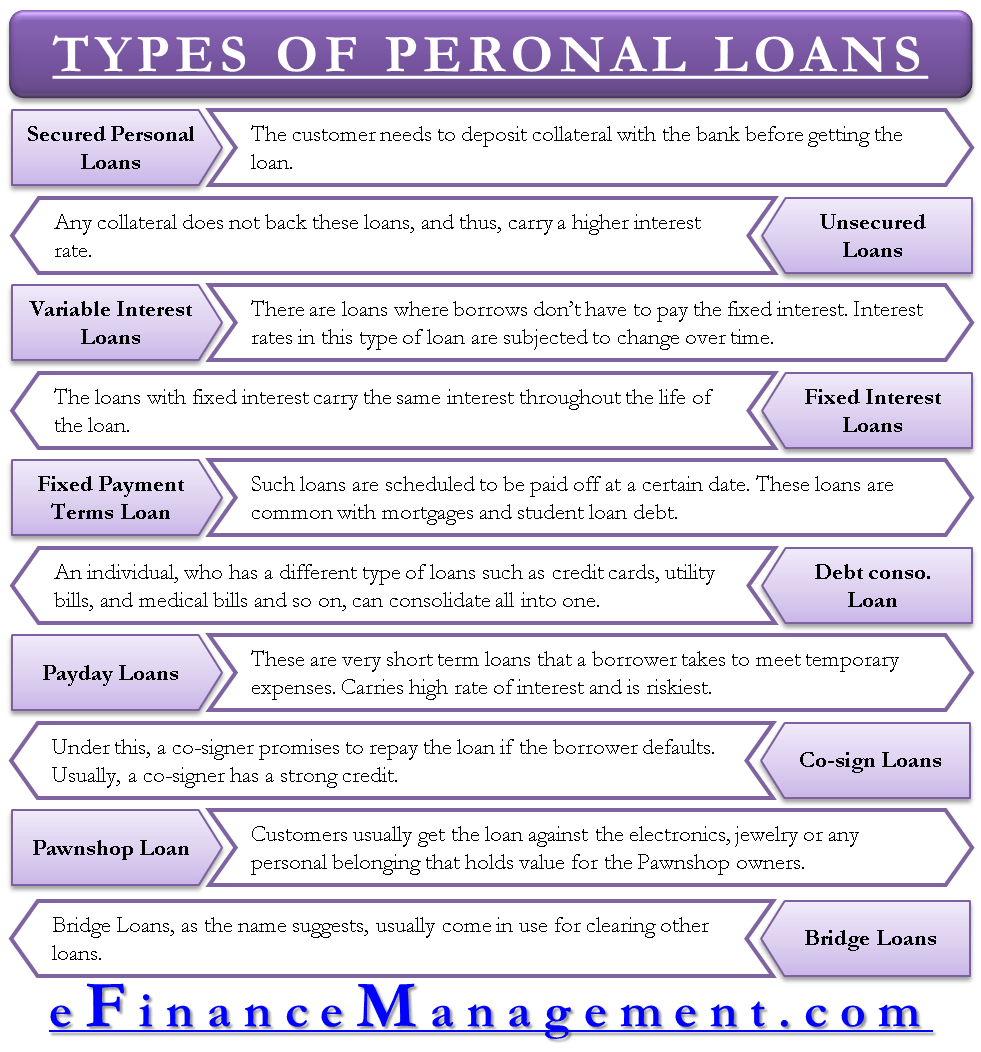

In this short article, we will guide you with the financing collection procedure, supplying efficient communication approaches, negotiation strategies, and also suggestions on using technology. Discover ideal practices for lawful activities in car loan collection.

Comprehending the Finance Collection Process

To recognize the lending collection process, you require to trust the professionals that are experienced in this area. They have the knowledge and also knowledge to browse the intricate world of financial obligation healing. These specialists recognize the ins and outs of the lawful structure bordering lending collection as well as can provide beneficial insights right into the best techniques for recuperating arrearages.

Funding collection is not as easy as sending out a few pointers or making a couple of phone telephone calls. It calls for a strategic strategy, tailored to each specific consumer's situations. The professionals have a deep understanding of the different collection techniques available and can identify the most effective training course of activity for each case.

By trusting the specialists, you can guarantee that the loan collection process is carried out properly and efficiently. They have the required devices and resources to communicate and locate with customers, work out repayment terms, as well as, if needed, start legal proceedings. Their experience in managing borrowers from numerous backgrounds and monetary situations permits them to handle each instance with sensitivity and also professionalism and trust.

Efficient Communication Approaches With Borrowers

Effective communication approaches with debtors can substantially improve the success of car loan collection efforts. By establishing clear lines of communication, you can successfully convey essential details as well as assumptions to customers, ultimately enhancing the likelihood of effective finance repayment. One vital strategy is to keep routine call with borrowers, maintaining them notified regarding their superior equilibrium, settlement alternatives, and any modifications in finance terms. This can be done via numerous channels, such as phone telephone calls, emails, and even sms message, depending on the consumer's preferred approach of communication. Furthermore, it is vital to utilize language that is clear, succinct, and also easy for debtors to recognize. Avoid using complicated jargon or technical terms that might perplex or frighten debtors. Instead, concentrate on discussing the scenario in a simple and also basic way. Another effective method is to actively pay attention to customers' worries as well as resolve them immediately. By showing compassion and also understanding, you can construct trust fund as well as relationship with consumers, making them extra happy to find a remedy and also work together. Generally, efficient communication is the key to effective loan collection initiatives, so make sure to prioritize it in your collection techniques.

Executing Settlement Methods for Successful Debt Recovery

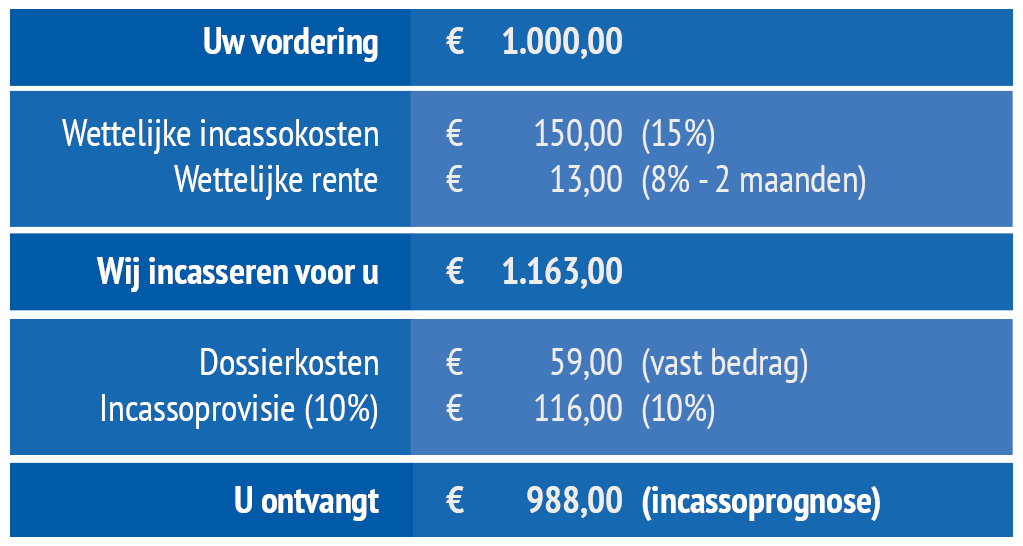

When applying settlement techniques for successful financial debt healing, you can make use of energetic listening skills to understand the consumer's viewpoint as well as locate equally advantageous services. By proactively listening check these guys out to what the debtor has to state, you can obtain useful understandings right into their economic scenario, factors for skipping, and also prospective repayment options. This will certainly permit you to customize your arrangement technique and deal appropriate remedies that resolve their issues.

Active paying attention includes offering your full attention to the consumer, preserving excellent eye call, and preventing disturbances. It additionally implies asking flexible questions to encourage the debtor to share even more info and clarify their needs. By doing so, you can develop count on as well as connection, which is crucial for successful negotiations.

Throughout the settlement procedure, it is important to remain calm, individual, and also understanding. Comprehend that the debtor may be experiencing economic problems as well as might be feeling bewildered.

Making Use Of Technology for Efficient Car Loan Collection

Utilizing modern technology can simplify the procedure of loan collection, making it a lot more efficient and hassle-free for both lending institutions and also consumers. With the arrival of sophisticated software application as well as online systems, loan providers can now automate several elements of car loan collection, saving time and sources.

Innovation enables loan providers to track as well as monitor financing repayments in real-time. Additionally, electronic records and paperwork make it simpler to keep exact as well as up-to-date loan records, reducing the possibilities of disputes or errors.

In general, leveraging technology in financing collection enhances efficiency, reduces prices, as well as enhances the borrower experience. Lenders can concentrate on other important tasks, while borrowers enjoy the benefit of electronic repayment alternatives and streamlined processes. Welcoming modern technology in loan collection is a win-win for both celebrations entailed.

Best Practices for Legal Actions in Lending Collection

One of the ideal practices for legal actions in funding collection is to talk to skilled lawyers that focus on debt recuperation. When it comes to lawful matters, it is vital to have experts in your corner that recognize the ins and outs of financial obligation collection regulations as well as guidelines. These specialized attorneys can supply you with the essential assistance and also competence to navigate the complex legal landscape and also guarantee that your lending collection initiatives are conducted within the limits of the legislation.

These lawyers can provide useful advice on alternate dispute resolution approaches, such as settlement or arbitration, which can aid you stay clear of costly as well as time-consuming court proceedings. They can likewise direct you in evaluating the threats as well as prospective end results of lawful activities, permitting you to make educated choices on just how to wage your financing collection efforts.

Overall, talking to seasoned attorneys that specialize in debt recuperation is a necessary finest practice when it concerns legal activities in finance collection. Their experience can make sure that you are adhering to the proper check out here lawful treatments as well as maximize your possibilities of efficiently recovering your lendings.

Final thought

By recognizing the lending collection procedure, applying effective interaction methods, utilizing settlement strategies, and also leveraging innovation, you can boost your opportunities of successful debt recuperation. Keep in mind, depending on experts in car loan collection can help you navigate the process with self-confidence and also achieve the wanted results.

Efficient communication approaches with customers can substantially improve the success of financing collection initiatives (credifin). On the whole, reliable communication is the essential to successful lending collection efforts, so make sure to prioritize it in your collection approaches